CareTrust REIT (NYSE: CTRE) has been a big winner in my Oxford Income Letter portfolio, with a total return of 173% in the 3 1/2 years since I recommended it.

Part of that total return has been from the company’s dividend yield. The current yield is 3.7%, though Oxford Income Letter subscribers who bought it when it was first recommended are earning over 8% annually on the original price.

Whether you’re earning more than 8% or today’s 3.7% or anything in between, you need to feel confident that the dividend is safe.

Let’s dig in and see if it is.

CareTrust REIT leases nursing homes and assisted and independent living facilities to operators. It has over 400 properties across 35 states and another 130 properties in the U.K.

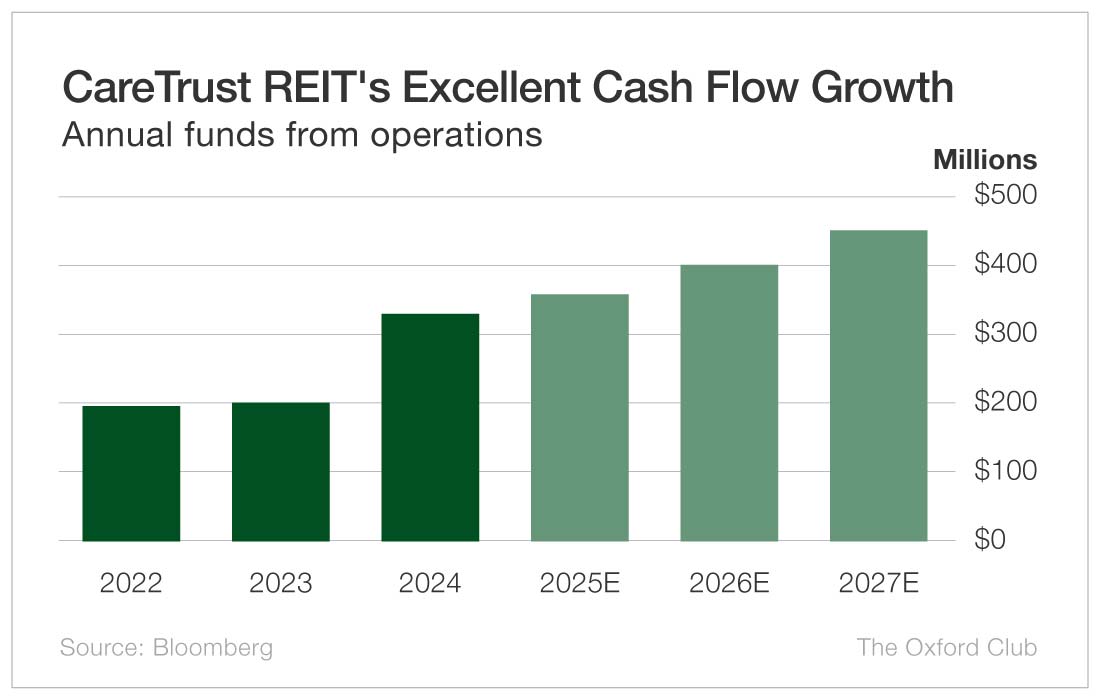

Because CareTrust is a REIT (real estate investment trust), we use a measure of cash flow called funds from operations, or FFO.

In 2024, FFO grew 66% to $331 million. Over the past three years, it has grown by an average of 17% per year. That’s exceptional.

This year, that growth is forecast to slow to 8%, with FFO coming in at $359 million. In 2026 and 2027, growth is expected to accelerate into the double digits again.

CareTrust REIT paid shareholders $172 million in dividends last year for a payout ratio of just 52%. This year, the projected $189 million in dividend payments should result in a payout ratio of 53%.

So the company generates nearly double the cash flow that it needs in order to pay the dividend. With FFO expected to continue to rise, the company should be able to keep raising the dividend, as it has every year since it began paying one in 2014.

CareTrust REIT has everything you want to see in a Perpetual Dividend Raiser. It has a stellar track record of annual dividend increases, it generates strong cash flow, and it has a low enough payout ratio to ensure that the dividend should remain intact even if the company hits an unexpected obstacle.

It’s no wonder the stock has performed so well over the past several years.

CareTrust REIT’s dividend is very safe.

Dividend Safety Rating: A

What stock’s dividend safety would you like me to analyze next? Leave the ticker in the comments section.

You can also take a look to see whether we’ve written about your favorite stock recently. Just click on the word “Search” at the top right part of the Wealthy Retirement homepage, type in the company name, and hit “Enter.”

Also, keep in mind that Safety Net can analyze only individual stocks, not exchange-traded funds, mutual funds, or closed-end funds.

The post This REIT Continues to Reward Investors appeared first on Wealthy Retirement.