Today, we’re doing something we’ve never done before.

In this special “new year” edition of Wealthy Retirement, we’re running a stock through the Safety Net model and The Value Meter… at the same time.

Using these two popular methodologies in tandem – one for dividend safety, the other for valuation – can give us a more complete picture of whether a stock is worth investing in.

Without further ado, here’s the first-ever combined edition of Safety Net and The Value Meter… featuring a company that just made a potentially industry-changing announcement.

Chief Income Strategist Marc Lichtenfeld

Safety Net

Now that the calendar has turned to 2026, lots of folks are making promises to themselves that they won’t keep. However, one resolution just got much easier.

Losing weight.

GLP-1 (glucagon-like peptide-1) drugs have been game changers for patients and the pharmaceutical companies that make them. Now, oral GLP-1 drugs will again move the needle significantly for customers and drugmakers.

Last week, Danish pharmaceutical giant Novo Nordisk (NYSE: NVO) received FDA approval for an oral version of Wegovy, which was previously available by injection only. The change to the company’s financial picture will be momentous.

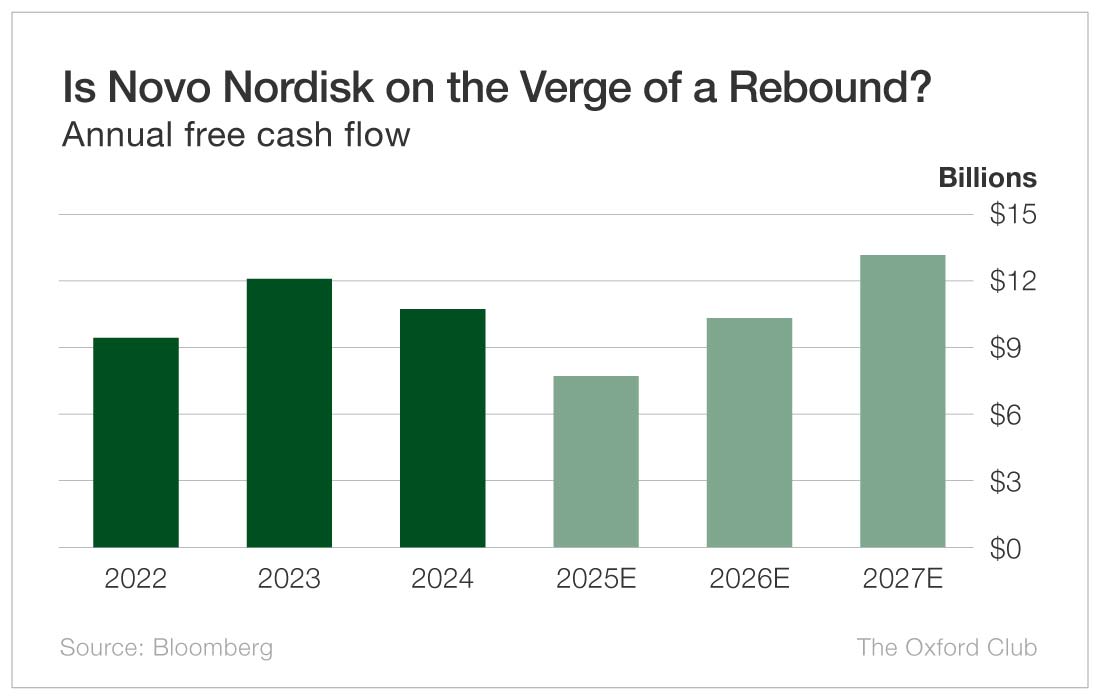

We won’t have the full 2025 figures until next month, but free cash flow is projected to come in at $7.7 billion, a 28% decline from 2024’s $10.7 billion and 36% below 2023’s total.

However, because of the new approval, free cash flow is expected to jump 34% to $10.3 billion in 2026 and another 27% in 2027 to $13.2 billion.

The sharp decline in 2025’s free cash flow costs Novo Nordisk a couple of points on its dividend safety rating.

Another issue is the payout ratio.

Novo Nordisk is expected to have paid shareholders $7.1 billion in dividends in 2025. If free cash flow slid 28% as projected, the payout ratio would rise to 92%, which is way too high.

This year’s projected $8.1 billion in dividends would lead to a payout ratio of 78% based on the consensus cash flow estimate. That is also too high, but it’s within spitting distance of the 75% threshold for Safety Net. If cash flow is a little higher than expected (or dividends paid is a little lower) in 2026, the payout ratio may come in below the 75% level, and the company would not be penalized.

In 2025, American investors received two semiannual dividends totaling $1.73 per share, which comes out to a 3.3% dividend yield.

In its local currency, the Danish krone, Novo Nordisk has raised its dividend for 31 consecutive years – though American investors may have seen slight reductions because of currency fluctuations.

Due to falling cash flow and a too-high payout ratio, Novo Nordisk’s dividend safety rating is low. But this is an unusual situation with the company’s fortunes about to change dramatically due to oral Wegovy.

Combine that with a three-decade run of annual dividend increases and a likely upgrade this year, and the dividend should be okay despite the poor rating.

Dividend Safety Rating: D

Director of Trading Anthony Summers

The Value Meter

Sometimes the best businesses make only decent stocks – not because the company slips, but because expectations outrun what the cash can reasonably deliver.

That’s the situation with Novo Nordisk today. The business is still excellent. The stock, after a long reset, is finally being treated with more discipline.

The company is the unquestioned global leader in diabetes and obesity treatments. And Ozempic and Wegovy – overnight name brands, it seems – have reshaped how investors think about the company.

For a while, the market assumed that dominance meant inevitability. But recent results remind us that even great businesses have limits.

Over the first nine months of 2025, sales rose 12%, or 15% at constant exchange rates. Operating profit increased 5%, held back by roughly 9 billion kroner (roughly $1.4 billion) in restructuring costs tied to a companywide transformation. Free cash flow came in at 63.9 billion kroner (about $10.1 billion). That’s lower than the previous year, but still substantial.

Capital spending climbed as Novo expanded its manufacturing capacity. That spending isn’t optional. It’s the cost of staying competitive in GLP-1 therapies. Management also narrowed guidance and lowered growth expectations for diabetes and obesity treatments.

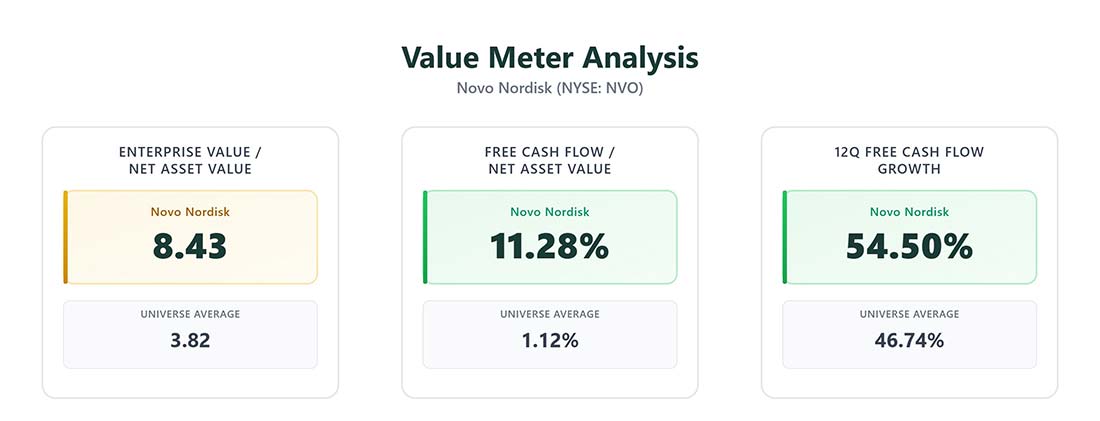

Novo trades at an enterprise value-to-net asset value ratio of 8.43, well above the universe average of 3.82. On that metric alone, the stock still looks expensive. The market continues to pay a premium for quality.

Cash flow is what keeps that premium from becoming a problem. Novo generates quarterly free cash flow equal to 11.28% of its net asset value. The universe average is just 1.12%. In plain terms, the company turns its assets into cash about 10 times more efficiently than the typical company. That matters.

Novo is consistent too. While the Safety Net model rewards year-over-year cash flow growth, The Value Meter prioritizes quarter-over-quarter growth. Over the past 12 quarters, the company grew its quarterly free cash flow 54.5% of the time, compared with 46.7% for peers. It also produced positive free cash flow in each of the past 12 quarters.

This isn’t a lucky stretch. It’s a durable pattern.

As we saw above, however, the stock has gone through a humbling year. Shares peaked in mid-2024 and slid through much of 2025.

That move wasn’t driven by collapsing fundamentals. It was driven by disappointment. Investors stopped paying for perfection.

That change is important. Novo is not cheap in absolute terms. You are still paying for elite assets. But you are no longer paying as if nothing can go wrong.

The business earns its valuation. The balance sheet is strong. The cash engine is real. What’s different now is the margin of safety. After the sell-off, it finally exists.

This isn’t a stock for traders chasing excitement. It’s for patient investors who want exposure to a world-class cash producer after expectations have cooled. The upside may be quieter from here, but it no longer depends on flawless execution.

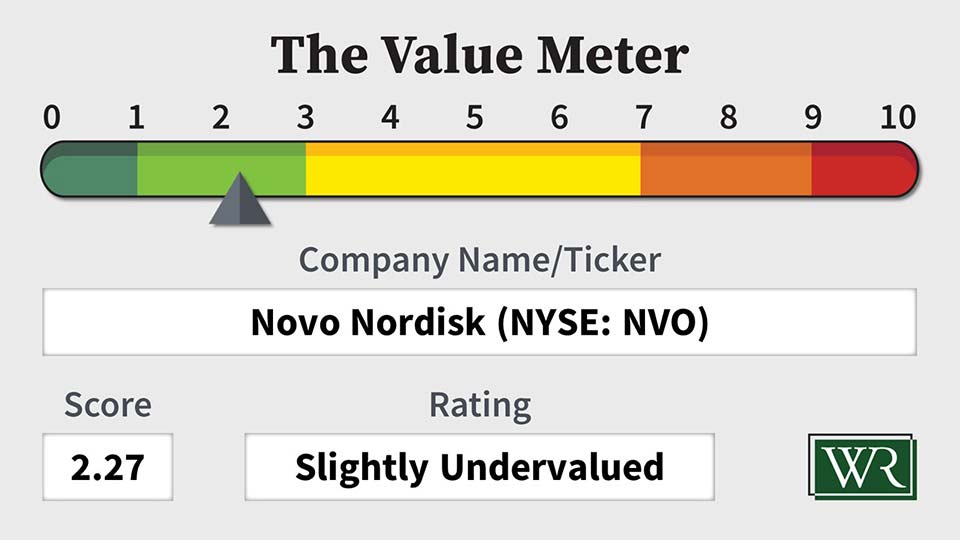

The Value Meter rates Novo Nordisk as “Slightly Undervalued.”

The post Novo Nordisk: What’s Next for the Pharma Giant? appeared first on Wealthy Retirement.