Editor’s Note: From time to time here in Wealthy Retirement, we choose to write about the same stock in Chief Income Strategist Marc Lichtenfeld’s Safety Net column (which evaluates stocks’ dividend safety) and Director of Trading Anthony Summers’ Value Meter column (which measures stocks’ valuations).

That’s the case this week with household-name retailer Target (NYSE: TGT).

To get Marc’s take on Target’s dividend, click here.

And to get Anthony’s take on its current valuation, keep reading below.

– James Ogletree, Senior Managing Editor

There’s a strange thing that happens when you become a parent. You start caring about stores you once walked past without a second thought. You know which checkout line is the fastest. You know where everything is. And you know that if you run in for toothpaste, you’ll somehow walk out with a cart full of things you didn’t plan on buying.

That store for many is Target (NYSE: TGT). It’s part of everyday life for millions of families.

But the market doesn’t give out points for mere familiarity. Since early 2024, Target’s stock has slid from above $175 to around $90.

That’s a big drop for a company most of us think of as rock-steady. So the real question is whether this is just a rough patch or a sign of something deeper.

Target reaches nearly 2,000 communities and has become a kind of modern general store. Its same-day pickup and delivery options have turned into a real draw, especially for busy households.

But even a strong brand can’t dodge a strained consumer. Shoppers have tightened up. Traffic is down. Margins are thinner than anyone would like.

The latest quarter reflects that mood. Net sales slipped 1.5% year over year to $25.3 billion. Comparable sales were down 2.7% – mostly because in-store traffic fell – but digital sales grew a bit. Earnings dropped from $1.85 to $1.51 per share, and operating income slid almost 19%.

Still, Target kept returning money to shareholders and now expects full-year earnings between $7.70 and $8.70.

It’s not a disaster. It’s a company pushing through a slow season in the consumer cycle.

When you strip things down to the basics – cash, assets, and consistency – the picture looks clearer.

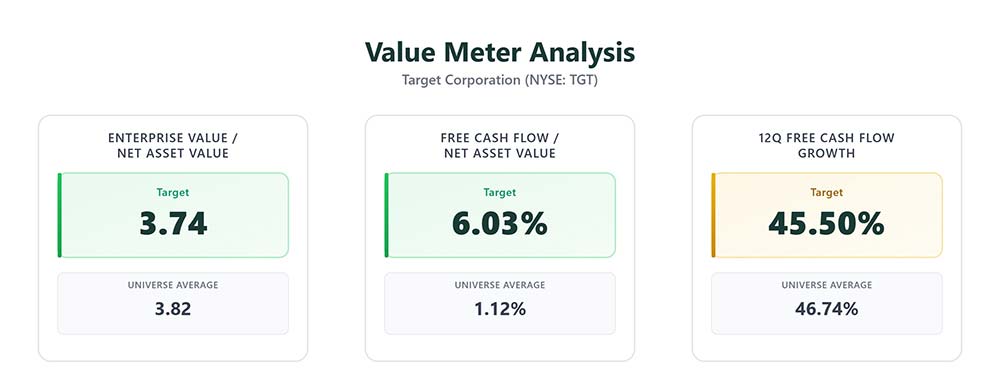

Target’s enterprise value-to-net asset value ratio sits at 3.74, almost identical to the 3.82 market average. You’re not getting a bargain, but you’re not paying up either.

Where Target still proves itself is in cash generation. Its 6.03% free cash flow-to-NAV rate towers over the 1.12% average. Even in a tough stretch, the company throws off real cash.

Over the last 12 quarters, it grew its free cash flow as often as the typical company in our database.

As you’ve seen, shares have drifted lower for nearly two years and now sit near 2020 levels. Moves like this can tempt bargain hunters, but only when the business is turning a corner.

Target isn’t there yet, honestly. Sales remain soft, margins are still tight, and management is bracing investors for another cautious quarter.

Still, if you shop there often, you know Target hasn’t lost its place in American life.

Good companies sometimes move sideways before they move forward. That’s part of the rhythm of retail. And right now, the market seems to have Target priced about right.

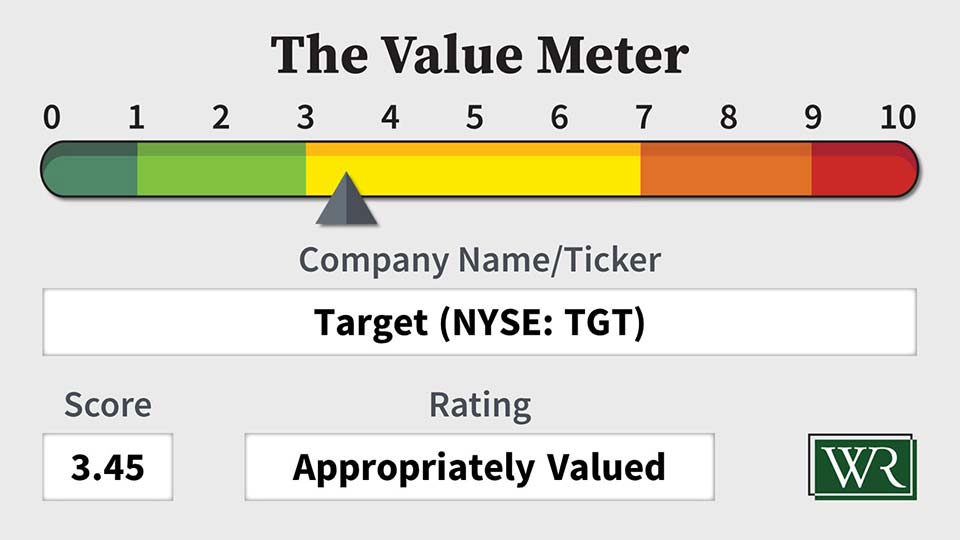

The Value Meter rates Target as “Appropriately Valued.”

What stock would you like me to run through The Value Meter next? Post the ticker symbol(s) in the comments section below.

The post Target: This Iconic Retail Stock Continues to Miss the Mark appeared first on Wealthy Retirement.