Mortgage real estate investment trusts, or mREITs, tend to have high yields, often double digits. While double-digit yields excite some investors, when I see one, my guard immediately goes up. I think, “Why is the yield so high when most dividend-paying companies – even those considered high-yield – have yields in the single digits?”

The reason for my skepticism is risk.

When a company pays a double-digit yield, the risk is higher that the stock is going to perform badly or the dividend is going to be cut. It’s not a guarantee that those things will happen, but it is more likely to happen than when the dividend yield is lower.

With that knowledge, let’s find out whether 15% yielder Dynex Capital (NYSE: DX) is in danger of cutting its dividend.

Dynex Capital is a mortgage REIT. It borrows money and then lends it out at higher interest rates. The difference, after expenses, is called net interest income.

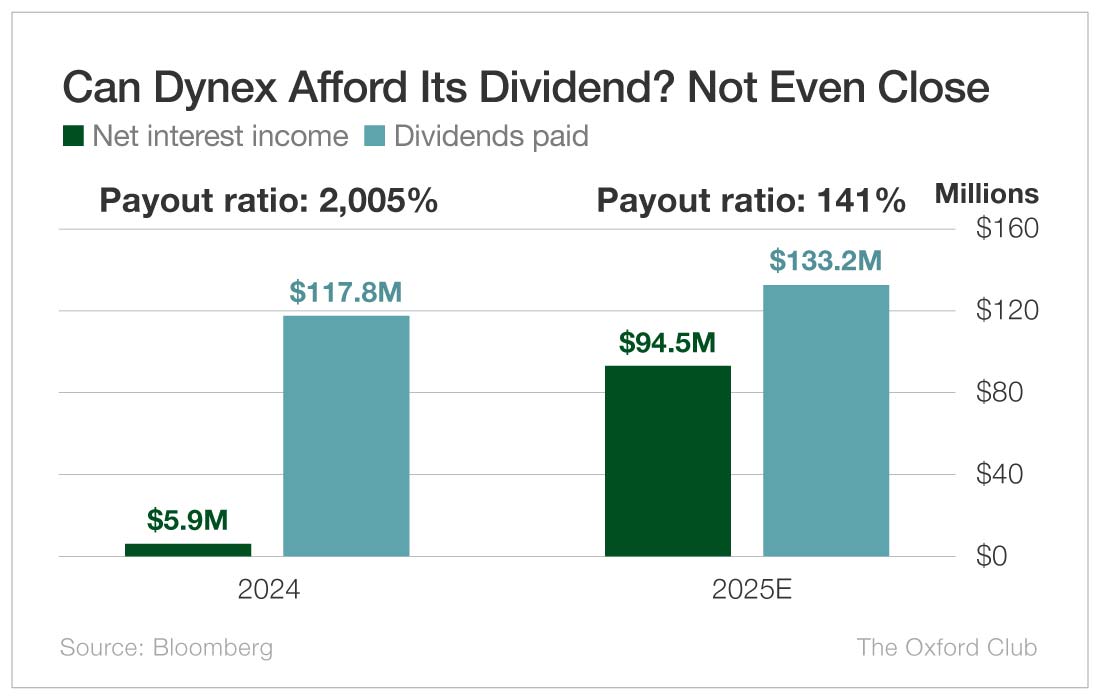

Last year, Dynex generated $5.9 million in net interest income while paying out $117.8 million in dividends. That means it paid 20 times more cash in dividends than it took in.

This year, I expect net interest income to rise significantly to $94.5 million. However, dividends paid are still forecast to be substantially higher at $133.2 million.

The dividend track record isn’t great either. Though Dynex has raised the monthly dividend twice in the past year from $0.13 per share to $0.17, it is still well below where it was 10 years ago.

At the time, Dynex paid a quarterly dividend of $0.72, which is 41% more than the current monthly dividend extrapolated to a quarterly dividend ($0.17 per month equals $0.51 per quarter). That $0.72 per share dividend in 2015 was cut to $0.63 in early 2016, and the company lowered the dividend again in 2017 to $0.54.

Two years later, Dynex began paying a monthly dividend, reducing it again to $0.15 ($0.45 quarterly) in mid-2019 and once more to $0.13 ($0.39 quarterly) in 2020.

So we have a stock that can’t afford its dividend and has cut the payout four times in the past 10 years.

Dynex Capital will very likely cut its dividend again soon.

The dividend is not safe.

Dividend Safety Rating: F

What stock’s dividend safety would you like me to analyze next? Leave the ticker in the comments section.

You can also take a look to see whether we’ve written about your favorite stock recently. Just click on the word “Search” at the top right part of the Wealthy Retirement homepage, type in the company name, and hit “Enter.”

Also, keep in mind that Safety Net can analyze only individual stocks, not exchange-traded funds, mutual funds, or closed-end funds.

The post Dynex: Will This 15% Yield Get Cut Again? appeared first on Wealthy Retirement.