Boo.

Now that the jump scares are out of the way, let’s talk about something truly frightening: being a shareholder of Fiserv (NYSE: FI).

I’m covering it for one reason only: It’s the worst-performing stock in the S&P 500 this year. Nearly two-thirds of its market value has vanished in just a few months.

For those who’ve held through the drop, it’s been a horror show. But the real question now is whether the frightful fundamentals are finally priced in.

The stock had already slid nearly 40% year to date entering this week, but the collapse came on Wednesday when the fintech firm slashed its annual earnings forecast and unveiled a broad executive shake-up.

Third quarter results showed the strain. Revenue missed expectations by more than 8%, operating income fell 10% year over year to $1.44 billion, and free cash flow fell 28% to $1.33 billion. Adjusted earnings per share dropped 11% to $2.04.

The company cut its full-year earnings per share forecast from a range of $10.15 to $10.30 to $8.50 to $8.60 – a 16% drop. That sent shares down 44% in a single day, the steepest fall in company history.

New CEO Mike Lyons called it a “critical and necessary reset.” Translation: Management uncovered accounting surprises, unrealistic growth assumptions, and weakness in Argentina.

The company is reorganizing under a new One Fiserv plan, with fresh leadership now steering its two core divisions – Merchant Solutions and Financial Solutions.

Fiserv still runs the digital “plumbing” of modern finance. It moves money and manages payments for banks like Citigroup and Wells Fargo, retailers such as Walmart, and even U.S. government agencies.

But investors don’t buy pipes; they buy profit flow. And right now, that flow looks uncertain.

Analysts haven’t been kind. Guidance cuts, board turnover, and vague long-term targets have shaken confidence. BTIG downgraded the stock, warning of a “laundry list of reasons” not to own it.

Still, total capitulation can create opportunity. When a company this central to the payments ecosystem resets expectations, it’s worth asking whether the pendulum has swung too far.

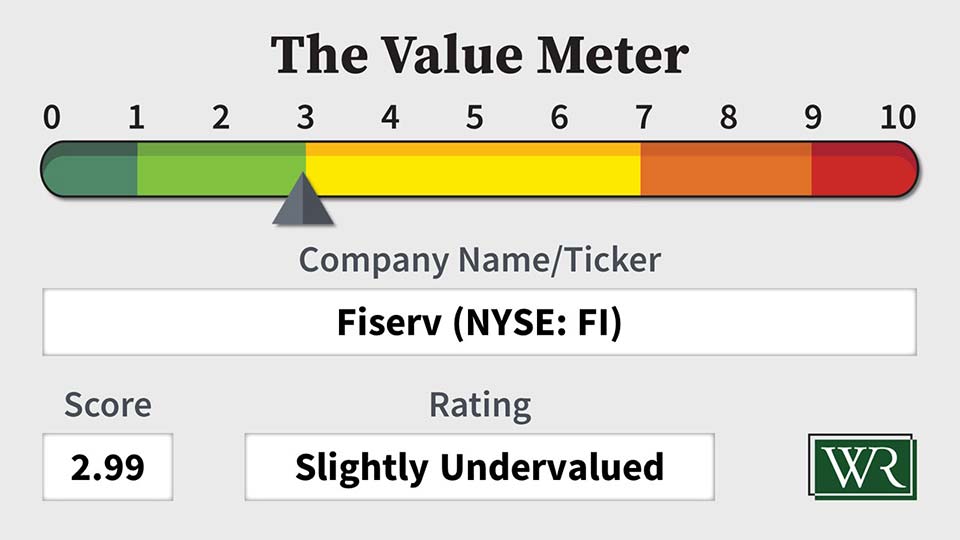

After all, The Value Meter doesn’t care about headlines – only fundamentals.

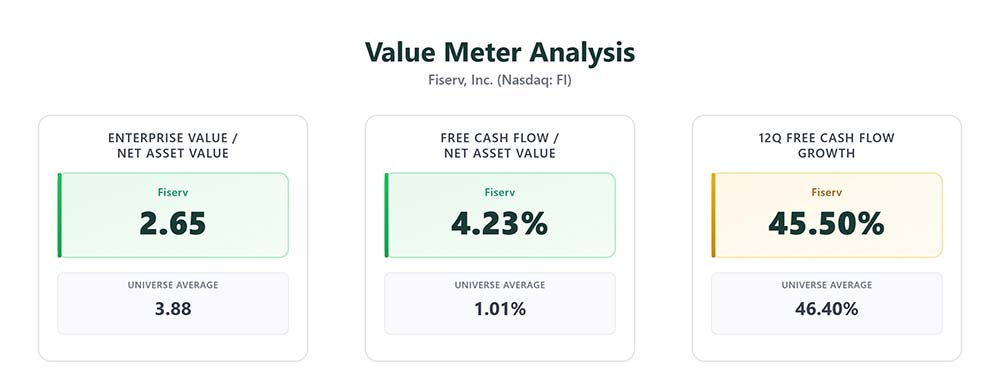

Fiserv’s enterprise value-to-net asset value (EV/NAV) ratio stands at 2.65, well below the universe average of 3.88 – a clear discount.

Its free cash flow-to-net asset value (FCF/NAV) comes in at 4.23%, more than four times the market’s 1.01% average.

And its 12-quarter free cash flow growth rate of 45.5% nearly matches the broad market’s 46.4%, showing that the engine’s still running even after the wreck.

Now, that doesn’t erase the company’s problems. Management still has to rebuild trust, stabilize margins, and prove that the reset wasn’t just spin. But when a profitable infrastructure firm trades at a discount while still producing healthy cash flow, the setup can be quietly compelling.

For now, fear dominates the narrative. But that’s usually when value begins to stir.

The Value Meter rates Fiserv as “Slightly Undervalued.”

What stock would you like me to run through The Value Meter next? Post the ticker symbol(s) in the comments section below.

The post Why Fiserv’s Bloodbath May Be Over appeared first on Wealthy Retirement.